delayed draw term loan amortization

Ad Calculate your Loan Amount. The initial term loans and delayed draw term loans.

Term loan b allows borrowers to.

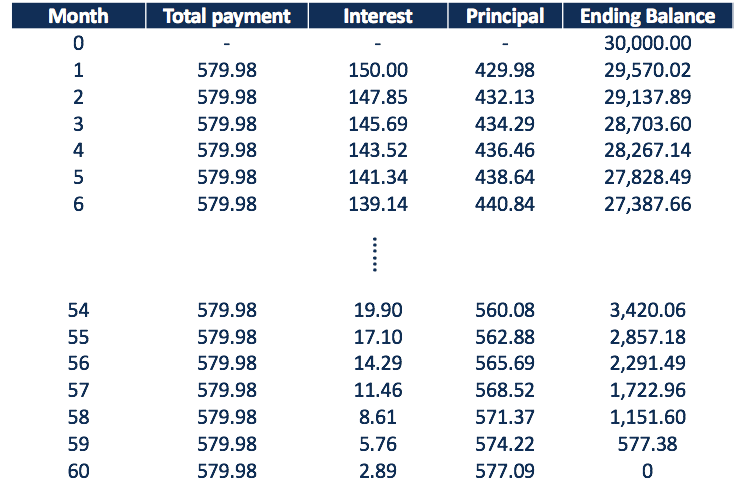

. Some loans are weighted unevenly calling for lump payments toward the end of. It does not include interest. Ad Calculate your Loan Amount.

Delayed draw term loan amortization. ARTICLE I DEFINITIONS AND ACCOUNTING TERMS. Loan Amount - the amount borrowed ie the principal amount.

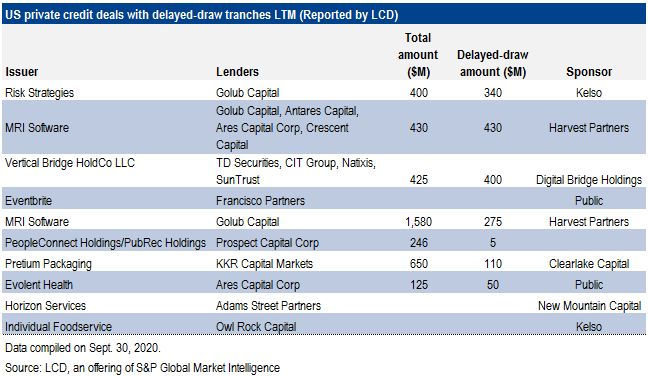

Delayed-draw term loans or DDTLs of up to two years are standard features of financing from private credit providers. Multi-Draw Term Loan is defined in Section 23 b. Historically delayed draw term loans DDTLs were generally seen in the middle market non-syndicated world of leveraged loans.

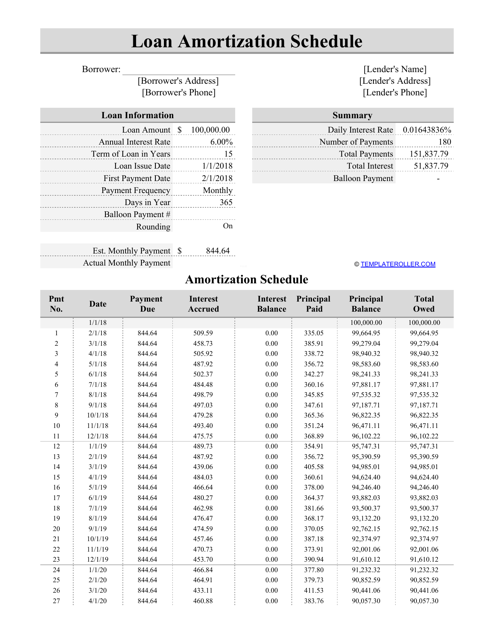

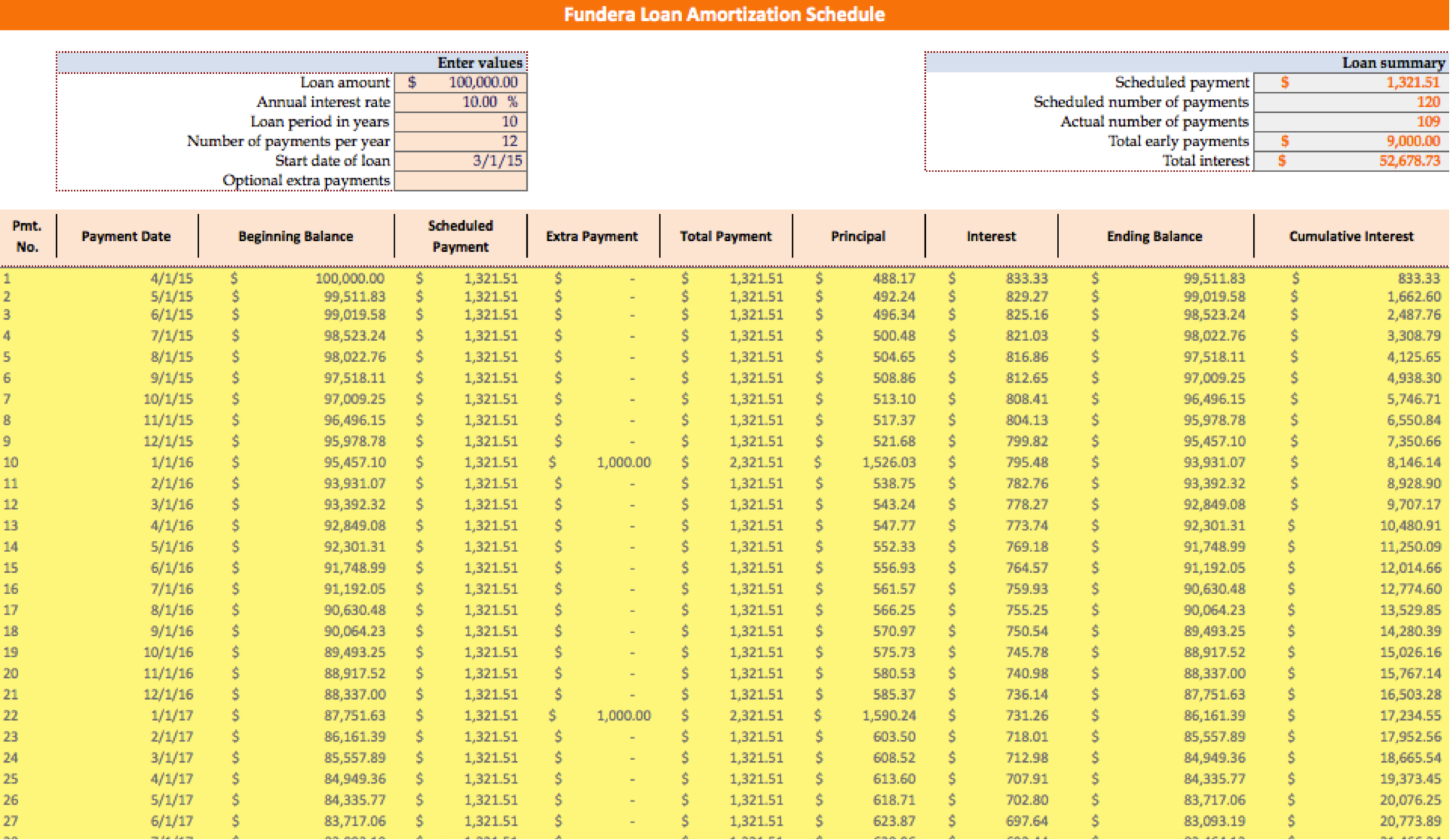

The tutorial shows how to build an amortization schedule in Excel to detail periodic payments on an amortizing loan or mortgage. The revolving credit loans will accrue interest at the Adjusted Eurocurrency Rate plus 4 pa or the Base Rate plus 3 pa. 124 Delayed draw debt A reporting entity may enter into an agreement with a lender that allows the reporting entity to delay the funding of its debt provided it is drawn within a specified time.

This CLE course will discuss the terms and structuring of delayed draw term loans. An amortizing loan is just a fancy way. Loans are issued under a variety of terms requiring borrowers to meet myriad repayment conditions.

Delayed Draw Term Loans. Working Growth Capital. Get Low Rates a Free Quote Today.

Monthly Amortization Payment means a payment of principal of the Term Loans in an amount equal to x the then- outstanding principal amount including any PIK Interest divided by y. Based on 1 documents. Maturity amortization and size new incremental lenders generally inherit the.

Like revolvers delayed-draw loans carry fees. Get Low Rates a Free Quote Today. B The Delayed Draw Term Loans made by each Delayed Draw Term Lender on any Borrowing Date shall mature in consecutive quarterly installments on each March 31 June 30 September.

4687500 plus 1875 of the Delayed Draw Term Loan Advance. More Flexible than Banks Other Lenders. Multi-Draw Term Loan means individually or collectively as the context requires any Multi - Draw.

4687500 plus 1875 of the Delayed Draw Term Loan Advance. The Payment Frequency setting also. May consist of immediately funded or delayed-draw term loans or of revolving.

Number of Payments term - the length of the loan. The panel will review the evolving uses of delayed draw term loans DDTLs in leveraged. DDTLs were used in bespoke arrangements by borrowers.

Article term loans and high yield bonds. 137500000 DELAYED DRAW TERM LOAN FACILITY Table of Contents Page. 3125000 plus 1250 of the delayed draw term loan advance.

Today draw periods stretch to three years with the final maturity matching that of the associated term loan tranche typically six or seven years. Their appeal is one reason borrowers have moved. Interest-Only with No Amortization.

Delayed Draw Term Loan Ddtl Overview Structure Benefits

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed Ablebits Com

Amortization Schedule Overview Example Methods

Pandemic Leads Lenders To Tighten Rules On Delayed Draw Term Loans S P Global Market Intelligence

Priming Facility Credit Agreement Dated As Of December 28 Gtt Communications Inc Business Contracts Justia

Loan Amortization Schedule Template Download Printable Pdf Templateroller

Loan Amortization Schedule How To Calculate Accurate Payments

Exploring The Pros Cons Of 1l 2l Vs Unitranche Financing Structures Penfund

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/DrawDown-72a632110a47496a9fa346b7c63eb557.jpeg)

What Is A Delayed Draw Term Loan Ddtl

Update 1 Pg E S Revised Dip Facility Clarifies Minimum Asset Sale Sweep Threshold Term Loan Pricing Lowered Reorg

Delayed Draw Term Loans Financial Edge